Walmarts of Tarrant County

A normal person might expect that Walmart Supercenters in a single county would have reasonably similar appraised values, at least when it comes to the building itself. After all, they're all about the same size and are built in the same way. But that normal person would be wrong. In fact, a statistically significant 75% of the variation in improvement values are described by changes in land values. In other words, TAD adjusts the appraised value of the consistent piece (the building) depending on the value of the changing piece (land) so that the total values across the county stay roughly in the same range.

We begin our WTF journey by looking at Walmart Supercenters in Tarrant County, Texas. We start here because big box stores are the lowest hanging fruit when it comes to picking on the property tax appraisal process in Texas. They're also one of the more frustrating elements.

Before we begin, it's important to keep in mind that the market for 180,000 square foot cinderblock boxes isn't necessarily robust. It's probably fair to say that there isn't much of a market for them. This fact has led to something called the Dark Store Theory, an appraisal methodology championed by many big box retailers. The idea is simple: if the tenant (like, say Lowe's) leaves, the building is worth very little. It won't sell. It will just sit, well, dark.

Fortunately, the Texas Legislature granted Central Appraisal Districts with a number of different options for appraising the value of commercial properties. When the sales comparison approach fails due to lack of a market, they can use the income or cost approach. File this one away, we'll get back to it in due course.

The data

We looked at 16 Walmart Supercenter locations in Tarrant County. Restricting ourselves to a single county helps to strip out the noise that might exist when you start trying to compare across multiple appraisal districts.

| Address | City | Year Built | Land Area (sqft) | Building Area (sqft) | Land Value | Improvement Value | Market Value | Land Value/sqft | Building Value/sqft | Market Value/sqft |

|---|---|---|---|---|---|---|---|---|---|---|

| 9500 WESTERN TRADE DR | Fort Worth | 2005 | 1,029,074 | 219,873 | $3,087,222 | $8,349,778 | $11,437,000 | $3.00 | $37.98 | $52.02 |

| 8500 JOHN T WHITE | Fort Worth | 1999 | 933,736 | 219,750 | $5,602,416 | $5,494,587 | $11,097,003 | $6.00 | $25.00 | $50.50 |

| 6401 NE LOOP 820 | North Richland Hills | 1992 | 1,079,225 | 227,672 | $4,316,900 | $6,720,100 | $11,037,000 | $4.00 | $29.52 | $48.48 |

| 1701 W STATE HWY 114 | Grapevine | 2003 | 1,021,427 | 207,905 | $5,107,135 | $5,811,865 | $10,919,000 | $5.00 | $27.95 | $52.52 |

| 1732 PRECINCT LINE RD | Hurst | 2002 | 1,119,124 | 207,186 | $5,036,058 | $5,844,942 | $10,881,000 | $4.50 | $28.21 | $52.52 |

| 9101 N TARRANT PKWY | North Richland Hills | 2002 | 1,017,010 | 208,693 | $8,136,080 | $2,730,920 | $10,867,000 | $8.00 | $13.09 | $52.07 |

| 3851 AIRPORT FWY | Fort Worth | 2004 | 921,926 | 205,254 | $4,148,667 | $6,440,333 | $10,589,000 | $4.50 | $31.38 | $51.59 |

| 8520 N BEACH ST | Fort Worth | 2003 | 958,305 | 201,170 | $3,833,220 | $6,731,780 | $10,565,000 | $4.00 | $33.46 | $52.52 |

| 4101 STATE HWY 121 | Bedford | 1995 | 1,157,389 | 209,388 | $5,756,946 | $4,787,054 | $10,544,000 | $4.97 | $22.86 | $50.36 |

| 5336 GOLDEN TRIANGLE BLVD | Keller | 2017 | 1,249,328 | 188,924 | $6,249,640 | $4,247,360 | $10,497,000 | $5.00 | $22.48 | $55.56 |

| 6300 OAKMONT BLVD | Fort Worth | 2003 | 933,773 | 209,702 | $5,135,752 | $5,293,248 | $10,429,000 | $5.50 | $25.24 | $49.73 |

| 2235 JACKSBORO HWY | Fort Worth | 2014 | 1,179,106 | 187,820 | $3,537,318 | $6,581,682 | $10,119,000 | $3.00 | $35.04 | $53.88 |

| 915 E RANDOL MILL RD | Arlington | 2005 | 708,983 | 188,416 | $7,089,830 | $2,805,170 | $9,895,000 | $10.00 | $14.89 | $52.52 |

| 6770 STATE HWY 183 | Westworth Village | 2005 | 562,795 | 203,818 | $2,251,180 | $7,096,820 | $9,348,000 | $4.00 | $34.82 | $45.86 |

| 2401 AVONDALE HASLET ROAD | Fort Worth | 2013 | 940,678 | 147,806 | $5,829,852 | $2,380,148 | $8,210,000 | $6.20 | $16.10 | $55.55 |

| 6360 LAKE WORTH BLVD | Lake Worth | 1987 | 581,479 | 201,648 | $2,907,395 | $4,303,175 | $7,210,570 | $5.00 | $21.34 | $35.76 |

These stores ranged from 147,806 to 222,672 square feet in size, and were built between 1987 and 2017 (only 4 were built before 2000, and 10 of the 16 have been built in the last 20 years).

The average market value of these 16 stores was $10,227,786. The median sits at $10,554,500. Two big outliers on the low end drag the average down quite a bit; both of those outliers sit 30% and 20% below average, while none of the other 14 stores are more than 12 percentage points away from average.

The analysis

Despite the outliers at the low end, we have a reasonably tight range of appraised values for stores across a single county. And you might be saying to yourself, well that makes sense!

Looking at tax value per square foot, the chart looks remarkably similar. In fact, it's almost the same chart. Aside from one major outlier at the bottom (which happens to be the oldest store located in Lake Worth), we see a pretty consistent appraisal between $45.86 and $55.56 per (building) square foot.

The problem with this, though, is that Walmarts take up a lot of land. Between 13 and 28 acres among these locations. And some of that land is more valuable than others. Some of it is a lot more expensive, actually.

The location on East Randol Mill - just across the street from the home of America's Team and Five-Time Super Bowl Champion Dallas Cowboys - is a pricey $10 a foot, while the Jacksboro Highway location sits on dirt that's worth just $3.

The Jacksboro store (the building itself) is about 600 square feet smaller, but it's valued at 2.35 times the Randol Mill store, with a total valuation about 2.3% more than the Randol Mill location.

It means Tarrant Appraisal District believes that the 187,820 square foot cinderblock box on Jacksboro Highway is worth 135% more than the 188,416 square foot cinderblock box across from AT&T Stadium. But it's the same store!

You might be asking, "Why would a building in kinda-west Fort Worth be valued at $35 a foot while basically the exact same store 20 miles away is valued at $15 a foot?" If so, you're asking a very good question. A 187,820 square foot Walmart building should have a similar tax value as a 188,416 square foot Walmart building located about 15 miles away. That's what a normal person would expect. All that's left is to add the land values based on each location, and you're good to go, right?

The problem with Walmart's appraisals in Tarrant County is not that the total valuations across the county are reasonably similar per-square-foot. It's that they don't actually account for the variations in land costs.

In the real world, real estate decisions depend heavily on land prices. In the big box tax appraisal world, land prices are just a variable that you tweak to get an agreed upon end result.

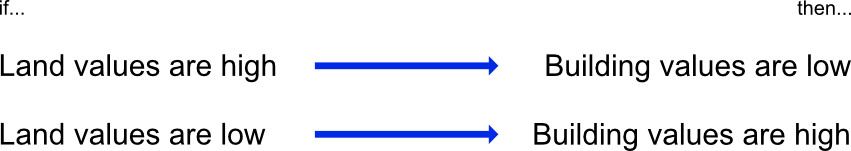

In fact, variations in land values account for about 75% of the variation in improvement values among these stores. In other words, if you tell me the land value, I can tell you within a reasonable tolerance what the box sitting on it will be appraised for. If land values are higher, improvement values go down; if land values are lower, improvement values go up. All for basically the same product.

Below is a highly scientific (but hopefully easy to follow) flow chart to help explain in more detail:

Getting back to those appraisal methods

Earlier, we talked about the various methodologies that can be used for appraisals: sales, income, and cost.

We're obviously not using the sales method here, because even if there were a market for these buildings, land prices would play a factor in the cost and they definitely aren't doing any heavy lifting right now.

Perhaps they're using the income method, which tries to assess what an investor might pay based on anticipated future revenue streams. Maybe one day we'll dig into this possibility, but suffice it to say we really don't think they're using the income method. You'll just have to trust us for now.

We also know that they're not using the cost method, which looks at replacement cost less depreciation. There's no real correlation between age and improvement costs in this sample, and the second oldest building has a higher per-square foot valuation than all but 5 of the stores. So that's also out.

While residential properties must, by law, be appraised as close as practicable to their current market value as a residential property, commercial appraisals are basically a black box. When it comes to Walmart (and as we'll see in future posts, plenty of other big box retailers), it's quite unclear what logic is being used to value their properties. Although we can't say definitively, it sure looks from the outside like TAD is using the "Walmart has fancy lawyers so just settle the appeal" method. And that kinda sucks for the healthy functioning of our property tax system, especially when residential property values are skyrocketing and tax rate compression is shifting even more burden to fast-appreciating properties.

OK, so now what?

We aren't quite sure if this blog is going to be one in which we offer solutions. Maybe one day, but not now. Future posts might also be a bit shorter, especially once we've explained certain terms and processes a few times. For now, just have fun stewing on the fact that Walmart tax appraisals are totally bogus. And don't forget, taxes are due in just a couple of months!